The Case for Japan: Part 2

The ‘Not China’ trade, and where we think Japan’s best investment opportunities can now be found

This Insight is not investment advice and should not be construed as such. Past performance is not predictive of future results. Fund(s) managed by Seraya Investment may be long or short securities mentioned in this Insight. Any resemblance of people or companies mentioned in this Insight to real entities is purely coincidental. Our full Disclaimer can be found here.

In Part 1 of this special two-part Insight, we watched Japan give a collective yawn as the Nikkei 225 Index hit a new high, puzzled over the Japanese government’s obsession with a ‘virtuous wage-price cycle’, took a brief look at Japan’s failure to implement structural reforms, and outlined some good reasons to buy Japanese stocks anyway.

In Part 2 of this special two-part Insight, we cover the ‘Not China’ trade, summarise what sectors and stocks performed best as foreign investors piled into the Japanese equity market in 2023, and outline where we think the best investment opportunities can now be found.

TABLE OF CONTENTS

The ‘Not China’ Trade – What has Performed in Japan?

The Japanese equity market traded sideways for most of 2021 and 2022 before surging in 2023.

The sudden outperformance of Japanese stocks followed a massive loss of investor confidence in China. This was because of concerns over the country’s handling of the COVID-19 pandemic, ongoing waves of regulatory crackdowns, and the ratcheting up of US-China tensions. Many funds were thus forced to pivot away from China fast!

Investors looked to the next most liquid market in Asia and quickly got stuck in. It was in this way that Japanese stocks became the biggest beneficiary of the ‘Not China’ trade.

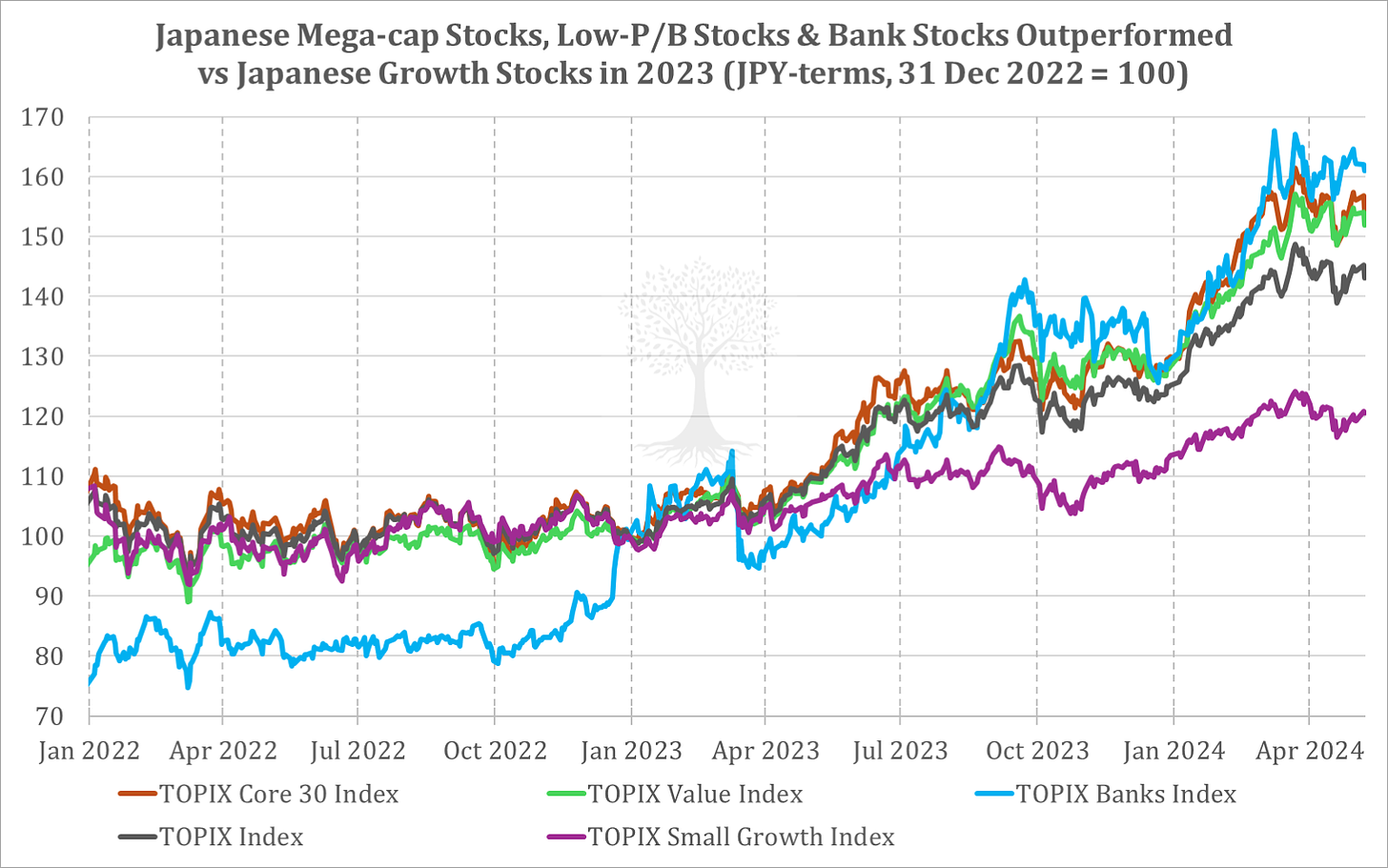

Broadly speaking, three groups of stocks have performed particularly well over the ~15 months since the Japan rally began (Figure 1):

The mega-caps and exporters: The TOPIX Core 30 Index advanced +57.8% from the start of 2023 to end-March 2024. (This compares to performance of +46.4% from the broader TOPIX Index.)

‘Value’ stocks trading at a low price-to-book multiple (‘P/B’) ratio: The TOPIX Value Index rose +54.6% over the same fifteen-month period.

Japanese banks: The TOPIX Banks Index appreciated by a massive +62.4% from Jan 2023 to March 2024.

Let’s look at each of these three groups of stocks in more detail…

(1) As international investors who were not very familiar with Japan quickly allocated capital towards the country, the first stocks they invested in were, unsurprisingly, the most liquid and familiar index names.

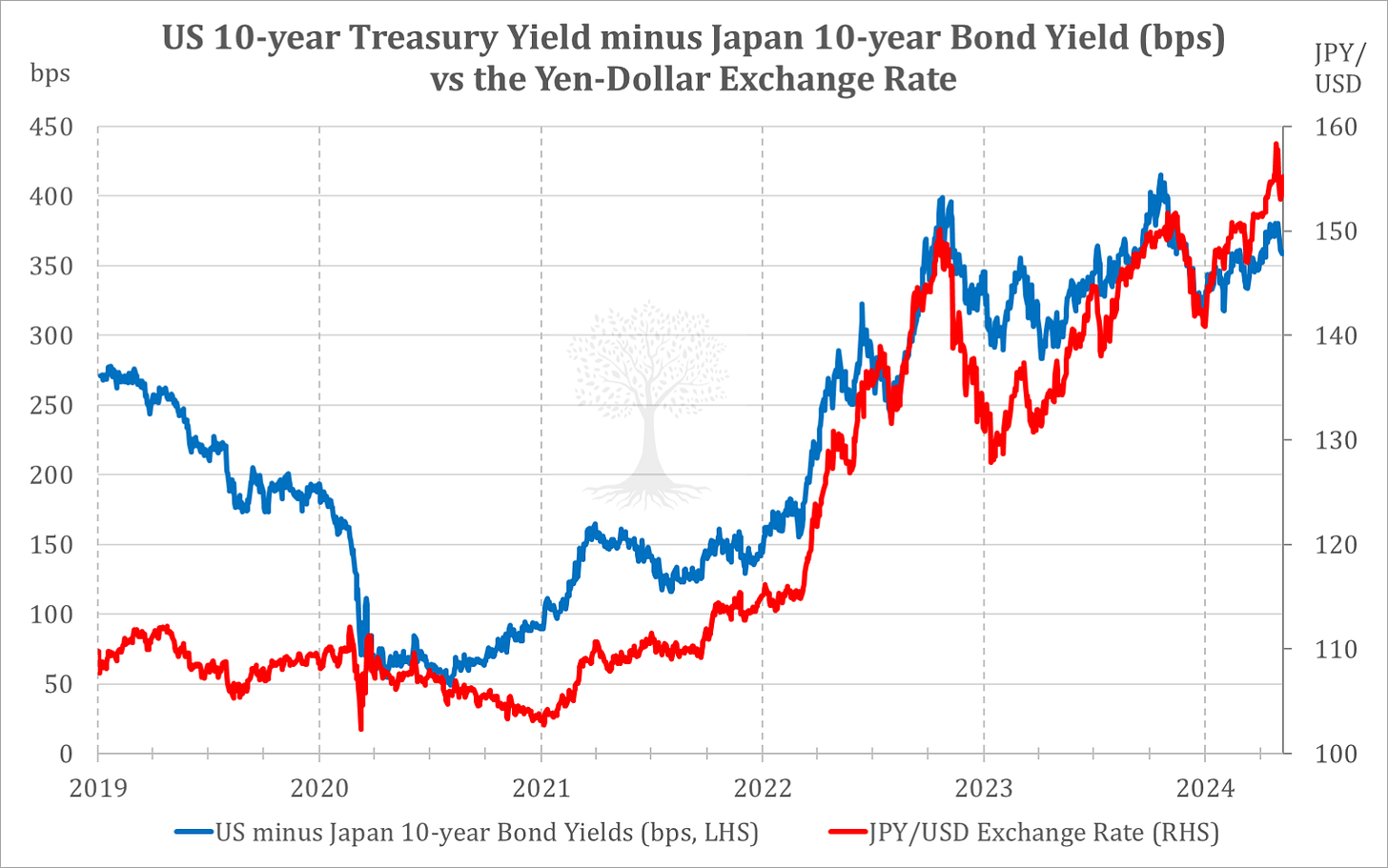

Macro conditions also gave many of these same businesses a boost, as around half of the mega-caps in Japan are also exporters which benefit from a weak Yen. The massive and widening interest rate differential between the US and Japan led to a dramatic weakening in the Yen in 2023 (continuing the 2022 trend), which in turn boosted the exporters’ profits (Figure 2).

As noted in Part 1, foreign investors not only bought all the JPY ~3.0tr in stocks that Japanese households sold in 2023 and more, they then also followed up with a further JPY ~1.5tr of net purchases in the first three months of 2024.

In other words, the combined force of the weaker Yen and strong foreign capital inflows has provided a tremendous tailwind for the mega-caps.

(2) The driving force behind the sudden rerating of Japan’s ‘cheapest’ companies appears to have been foreign investors suddenly ‘buying into’ Japan’s corporate governance reforms.

In 2023, this typically manifested as hedge funds requesting their prime brokerage desks to put together baskets of low P/B stocks for them to purchase. In this case, the business fundamentals of the companies were less important than a low price relative to net asset value! (Note that some of the stocks which have been rerated probably do not deserve a higher valuation, given that their assets are not able to produce an acceptable level of cash flows. However, none of that mattered very much in 2023.)

Leaving aside the merits of blindly buying low P/B stocks, it is important to note that Japan’s corporate governance improvements are real, and have been endorsed by both the regulator and the stock exchange. Rather than an overnight revolution deserving an immediate rerating, however, these reforms would be better characterised as gradual steps which have taken almost a decade to implement.

Ironically, we think that a growing cast of Japan ‘activist investors’ are now pushing an exciting narrative around ‘sudden transformation’ in Japan, just at a moment when it is getting harder to find interesting and liquid opportunities. In other words, the lowest hanging large-cap fruit, which activists have usually targeted with demands to reduce cross-shareholdings and excess cash by increasing dividends and buybacks, have mostly been plucked.1

Indeed, we see that some of the more well-known Japan activists are already shifting their modus operandi away from demanding higher payouts from cash-rich companies. Instead, they are now approaching target firms with requests for divestment of real estate holdings or even art collections(!), as well as pleas for business improvements and cost rationalisations.2

(3) Given that the TOPIX Banks Index started 2023 at a price-to-book ratio of ~0.56x, and by the end of March 2024 were sporting a book value multiple of ~0.79x, one might say that the rally in Japanese banks is really a subset of the ‘low P/B trade’ mentioned above.

Nonetheless, we believe the dynamics and drivers of this financials rally have been subtly different. For the banks, the force behind the rerating appears to have been macro traders who wished to speculate on interest rate normalisation from the Bank of Japan (‘BoJ’).

The BoJ owns more than half of outstanding government bonds, and bond market liquidity has been poor in recent years.3 The rate-sensitive and relatively liquid banking sector, on the other hand, is arguably the largest beneficiary of positive interest rates and a steeper yield curve. This made it easier to place a bet on the banks rather than shorting bonds.

Despite the BoJ’s slow progress to normalise rates, Japanese bank stocks have still performed well, as the yield curve has steepened and investors still appear to expect further interest rate hikes and higher bank profits in the future.

Market Inefficiencies = Opportunities

Given the massive outperformance from Japanese stocks over the last eighteen months, is now really the right time to be buying?

The palpable frustration from the retail investor at the NISA presentation who had ‘missed the rally’ was understandable.4 However, he is not alone. Many thoughtful specialist Japan fund managers also underperformed in 2022 and 2023.

As we never tire of saying, Asia is home to some of the most inefficient markets on earth. Among them, Japan – which boasts >4,000 listed stocks, along with an unusual business culture and challenging language – is perhaps the most idiosyncratic. There are always opportunities in Japan, it’s just that at some moments you need to work harder than at others to find them.

2022 was a terrible year for most ‘growth’-oriented investors around the world. As US interest rates rose rapidly, these investors suddenly started to worry if their portfolio companies would ever produce profits! In contrast, 2023 saw many tech stocks listed outside Japan (especially those with profits and cash flows) bounce back strongly.

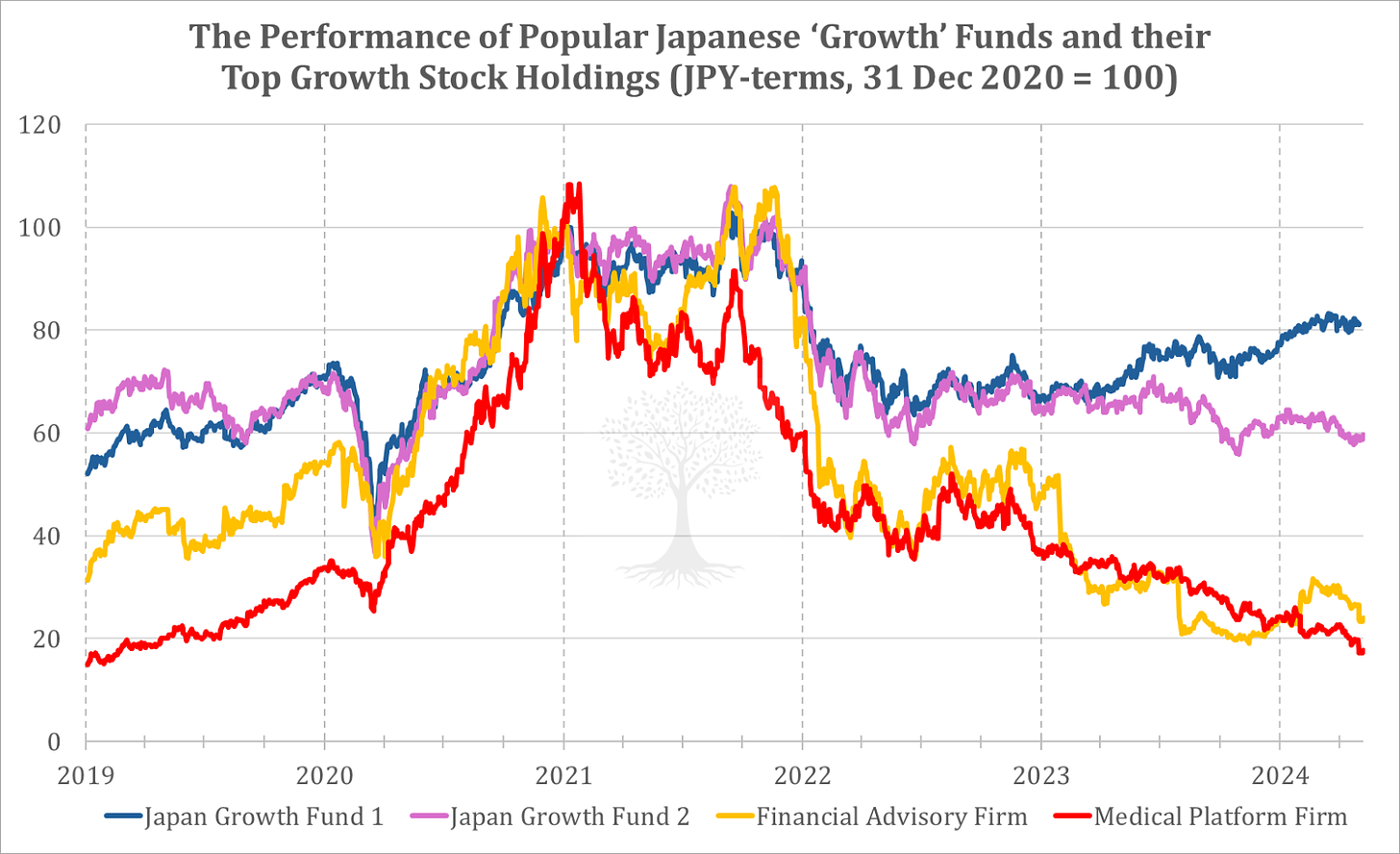

In Japan, however, both 2022 and 2023 were terrible years for growth-oriented fund managers (Figure 4). Some of the most prominent Japanese growth funds and their favourite stocks were bludgeoned, with the stock prices of their most popular holdings halving and then halving again for peak-to-trough losses in the -70-90% range!5

As regular readers know, by nature we identify more as ‘value’ investors rather than as ‘growth’ investors. In Japan, however, there now exists an unusual situation where stocks which have been compounding at rates of >20% per annum for the last 10-15 years, and which used to trade at P/E multiples of 50-100x, are now on sale!

Most of these companies are focused on the domestic market rather than on exports, and many experienced a growth hiccough as the pandemic ended. For some of these firms, the hiatus in growth does appear to point to more serious, long-term challenges to their business models that will not easily be resolved. These stocks probably deserve to trade at a lower multiple than in the past.

For a fair few companies, however, we think that growth will return and the compounding will continue! Some stocks which sported multiples of >50x earnings are now on offer for P/E ratios in the low- to mid-teens. We anticipate that many of these companies should see a trough in earnings growth sometime this year, with faster growth set to resume thereafter.

Separately, we are also finding interesting opportunities in specific areas which benefit from Japan-specific trends, such as Demographics, Digitalisation and Domestic capex (the three ‘D’s).

For the moment, the weak Yen and foreign flows are still dominating the investment narrative for Japan. Of course, we don’t doubt that current trends have the potential to extend even further. Indeed, it’s not hard to imagine how further redemptions for growth-oriented funds might lead to a continuation in forced selling, potentially creating even more compelling long-term buying opportunities for those who are patient.

Soon enough, however, we believe that the bottom-up fundamentals are likely to reassert themselves. At that moment, stock-picking should make a comeback! It’s exciting to think that it should be possible to pick up Japanese compounder stocks at bargain prices. We are watching and waiting.

Thank you for reading.

Andrew Limond

That said, we still think there are probably good ‘activist’ opportunities in certain areas, such as among micro- to small-cap stocks, and among some larger financial companies (i.e., by reducing cross-shareholdings). There are also still tremendous opportunities for private equity investors to continue their successful strategy of privatising cashed-up Japanese companies. We are also excited about the relaxation in M&A rules, and the possibility that this will kickstart more domestic takeovers, including unsolicited and maybe even hostile bids. The most successful activist investors in Japan have arguably been the domestic activists, and we expect this to continue.

It’s possible that some ‘activists’ don’t have the requisite experience and credibility to navigate some of these more challenging opportunities. It is also unclear what might be the eventual regulatory reaction to such new developments, especially if some of the newer activist proposals involve advocating for headcount reductions at target companies.

That said, liquidity in the bond market appears to have picked up recently, with the Bank of Japan moving away from more aggressive bond buying as it slowly distances itself from yield curve control.

For more information on the man who missed the rally, see the following Seraya insight: ‘The Case for Japan: Part 1’.

Japanese small-caps in general have underperformed large-caps for most of the last five years. The recent underperformance of various popular Japanese small- to mid-cap growth stocks since 2021, however, has been particularly extreme, and has meant that these stocks have effectively given up all their outperformance from the pandemic period.