Case Study of a Testing ‘Compounder’

A case study of a Taiwanese company with dominant market share in the global wireless testing market

This Insight is not investment advice and should not be construed as such. Past performance is not predictive of future results. Fund(s) managed by Seraya Investment may be long or short securities mentioned in this Insight. Any resemblance of people or companies mentioned in this Insight to real entities is purely coincidental. Our full Disclaimer can be found here.

This Insight is an extract adapted from the Panah Fund letter to investors for Q4 2020.1

In previous letters we have profiled various core ‘compounder’ holdings, many of which remain in the portfolio today. Examples include the profiles of Panah’s largest holdings, a Vietnamese industrial conglomerate and a Vietnamese ICT firm.2

In this letter, we profile our third largest holding. This is a Taiwanese company which is increasingly coming to dominate a small but essential business niche.

Founded in Taiwan in 1986 and listed in 2002, this company is the world’s leading independent provider of wireless device testing and certification services.

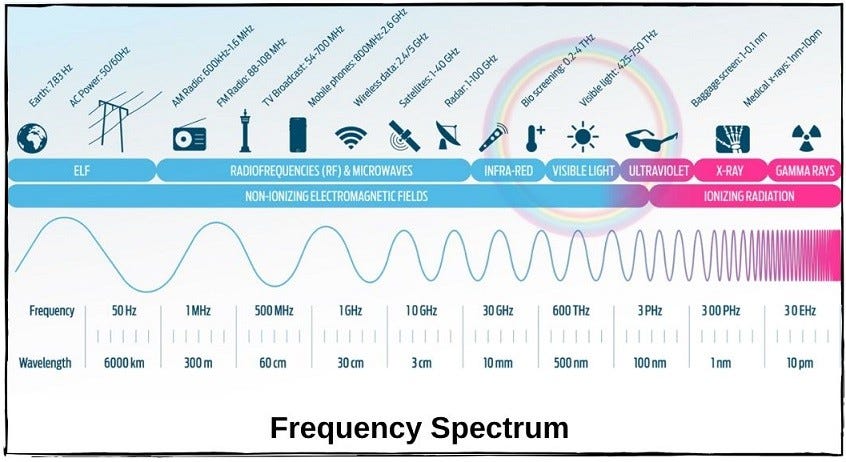

Regulators around the world mandate that every product which makes use of regulated frequencies must be tested before mass production and sale to consumers. This is to ensure that the radio waves from these devices do not cause electromagnetic interference (‘EMI’) with other electronic devices or cause any harm to people. Manufacturers of these wireless products also need to test their products for conformance to industry standards and expected performance.

This company is at the cutting edge of providing testing for any device with wireless communications capability. Every time that a new mobile communications standard (e.g., 3G/4G/5G) or wireless standard is introduced, all new electronic device models must be tested to ensure their compliance with the old and the new standards.

Currently, ~40% of the firm’s testing and certification revenues derive from mobile handsets, 25% from networking (e.g., WiFi and Bluetooth), and 25% from other electronics (e.g., IoT).

The company pre-dates the ‘mobile era’. When the business started life in 1986, it was focused purely on EMI testing for other electronics manufacturers. The company’s first safety-related testing lab was established in 1993. Throughout the 1990s, the company focused on meeting international requirements and receiving full accreditations from the leading official regulatory bodies around the world (e.g., the FCC in the US). In 2003, the company opened its first wireless testing lab.

Fast forward to today, and the company is a recognised wireless testing service operator in 150 countries. It fields 12 testing labs across Taiwan, China, the US, and Germany, and employs more than 1,000 staff, most of whom are electronics and telecommunications engineers. It is also an active participant in all major international certification organisations.

For the last three years, the company has commanded the #1 position in global wireless testing. Market share in 2020 was estimated at ~17% for devices using combined 3G/4G-LTE/5G wireless standards, as well as for the global WLAN (i.e., WiFi) testing market.

The company’s competitors comprise well-known international testing companies such as SGS Group, UL Group, Bureau Veritas Group, TUV Rheinland, as well as Centre Testing (based in China). These peers run inspection, verification, testing, and certification businesses across a large swathe of areas, with aggregate revenues of ~US $17bn in 2019. Wireless-related testing contributes just a small part of these companies’ overall business, in contrast to our Taiwanese investee which derives almost all of its ~$100mn in annual revenues from this domain.

This focus has enabled the company to focus its engineering prowess on developing cutting-edge testing processes for the latest telecommunications and wireless standards. For instance, in 2019 the company gained the US FCC’s very first certification for the extremely high frequency version of 5G for mobile and fixed wireless devices, as well as the EU’s first certification for the sub-6GHz version of 5G.3

The company has thus been able to offer 5G device testing services since late 2018. Thanks to this technological head start, it has so far been able to gain a ~50% market share for this new standard.

The major competitors are thus spread thinly over numerous testing areas and appear to be gradually losing market share in wireless testing. Barriers to entry for this industry for new potential competitors are also high, given the need to obtain certification from regulatory bodies and also to persuade customers that one can deliver a flawless testing and certification service for both historic and cutting-edge technology standards. The company is thus becoming increasingly dominant in this attractive niche area.

Historically, the company’s revenues and profits have taken a step up every time that a new mobile communications standard is introduced and new handset models are rolled out. During the first few years of such a ‘technology shift’, the company typically sees stronger testing volumes, higher ASPs and rising gross margins (towards the upper end of the company’s historical GPM range of 45-50%). This usually results in a large jump in profits.

Towards the back end of each technology lifecycle, testing volumes still tend to grow, albeit more slowly, while ASPs and margins trend slightly lower even as investment increases (in preparation for the next upcycle). This makes for flatter profit growth, although profits rarely shrink.

The consumer wireless device market is very competitive, and manufacturers must continuously upgrade their product portfolios to retain their customers’ attention. This continuous product refresh cycle, combined with mandatory testing and conformance requirements for every new model, means steady recurring revenues for the company even in the late years of each technology lifecycle.

The stock listed in 2002 at around the same time as the WCDMA 3G upcycle which began in the early 2000s. From 2009, the start of the 4G cycle is then clearly visible in the company’s mid-teens revenue growth for several years thereafter. (The company suffered little impact from the Global Financial Crisis.)

The current shift towards 5G has now started, which we believe will be a ‘supercycle’ in terms of testing volumes, pricing, as well as the duration of the upswing.4 As well as strong revenue growth, we also see a possibility that the company’s operating profit margins will increase beyond the upper end of the historical range of 25-30%.

We have been familiar with this testing company since the early 2010s, and have visited management regularly during our trips to Taiwan over the last decade. By the mid-2010s, valuations had already increased due to several years of attractive profit growth, while earnings growth was already starting to fade as the company reached the back end of its 4G testing cycle. We thus practiced patience while waiting for the cycle to turn.

It was not until late 2018 that we made our initial investment in the stock. 2018 was a transition year: 4G testing was continuing slowly, and the company was already in discussion with several customers in the US and China about placing new 5G orders. Meanwhile, the company was also making investments in new testing facilities in the US and China which weighed on earnings.

In late 2018, there was a sharp sell-off in the stock price. This enabled Panah to establish a starting position at a multiple of ~14x consensus forward earnings. (Our own valuation estimates were slightly cheaper than this, as our profit estimates were higher than the market). We deemed this to be an attractive valuation for a strong cash flow generative firm, operating in an attractive niche, with growing market share and at the start of a new upcycle. We continued to add to the position in early 2019.

Since then, the stock price has doubled, and the company now trades on a multiple of ~24x FY21 and ~19x FY22 consensus earnings (which we also consider conservative). The current operating cash flow yield is ~6%, and near-term capex requirements are minimal. The company is in a strong net cash position (~15% of its asset base) and consistently pays out ~80% of its earnings.

While such valuations are higher than for most other positions in the fund, we do not see this as expensive given the quality of the business and a strong possibility of >20% average earnings growth in the coming years. Indeed, since 2005 the company has compounded its book value per share (assuming dividends reinvested) at a rate of ~25% per annum, and we think even higher returns are possible in the coming years.

This growth will be driven by testing for the nascent 5G ‘supercycle’, as well as new opportunities in low-power IoT wireless standards for home appliances. There is also potential upside in the form of the broadening of business activities to include automotive end applications (as cars go ‘digital’). The company is currently in the process of applying for certification from various top-tier auto suppliers in China and elsewhere. Finally, there might also be further opportunities to open local testing labs in countries such as Indonesia and India.

Downside risks include increasing hiring competition for test engineers (a major part of the company’s cost base), a delay in the start of the 5G cycle, a more muted 5G product rollout than expected, and greater testing competition leading to faster-than-expected erosion in ASPs.

Nevertheless, given the company’s experience with past mobile and WLAN technology shifts, its growing market share now, and its impeccable track record with customers, we believe that it will be the major testing beneficiary of the coming global 5G and WiFi 6 upcycles.

Thank you for reading.

Andrew Limond, Romain Rigby

The original source material has been edited for spelling, punctuation, grammar and clarity. Photographs, illustrations, diagrams and references have been updated to ensure relevance. Copies of the original quarterly letter source material are available to investors on request.

For more information on these two companies, see the Panah Fund letter to investors for Q4 2016 and Q3 2018, as well as the following Seraya Insights: ‘“Capital Allocators” versus “Capital Alligators”’ and ‘“Compounders”: The Ultimate 'Lazy' Investment Choice?’.

For 5G, the two main types of frequency ranges are sub-6GHz and millimetre wave (>24GHz). An explanation of the difference and utility of the two frequency ranges in 5G can be found here.

Initial testing ASPs for Non-standalone (‘NSA’) 5G devices (i.e., used in combination with 4G networks) will likely be ~50% higher than comparable 4G devices, while subsequent pricing for testing Standalone (‘SA’) 5G devices might be much higher. For an explanation of the differences between NSA and SA, see here.