Uranium: Reflexivity in Action

Uranium is in a bull market, although the path to profits has taken some unexpected turns

This Insight is not investment advice and should not be construed as such. Past performance is not predictive of future results. Fund(s) managed by Seraya Investment may be long or short securities mentioned in this Insight. Any resemblance of people or companies mentioned in this Insight to real entities is purely coincidental. Our full Disclaimer can be found here.

This Insight is an extract adapted from the Panah Fund letter to investors for Q1 2021.1

TABLE OF CONTENTS

Our Original Uranium Investment Thesis

Regular readers will know that Panah has had a constructive view on the uranium market for the last two years.2

In simple terms, our investment thesis has been that demand for nuclear power (and uranium) will grow at a steady pace in the 2020s. This is as China and other developing nations boost the number of nuclear power reactors in operation, and as developed nations seek to meet carbon reduction targets - with safer and more efficient nuclear technologies supporting adoption.

Meanwhile, the uranium mining market has been in a serious bear market for more than a decade. Mine production has fallen to multi-year lows, with deficits set to last for many years given a lack of new exploration and permitting activity.

Inventories of uranium have also been drawn down over this period, especially in 2020 as Covid-19 shuttered mines around the world. We anticipate multi-year uranium supply deficits, meaning that nuclear utilities will likely have to pay significantly higher prices to secure offtake agreements with the miners.

The last six months has seen a massive rally in the share prices of the uranium miners. While this has made a welcome contribution to portfolio performance, this rally has not happened in the manner or for the reasons that we expected!

The spot price of uranium3 bottomed at US ~$18/lb in late 2016 before recovering to ~$29/lb by end-2018. The price then slipped back towards US $24/lb by March 2020, before embarking on a two-month surge to $34/lb as the pandemic closed mines and as major producers rushed to secure additional pounds in the spot market to fulfil their contracts with utilities. Since then, the price has gently slipped as some major buyers stepped back from the market. For the last few months, the spot price has settled below US $30/lb.

For reference, we estimate that a contract price of US ~$60/lb is required to incentivise new uranium primary mine supply (and meet the current ~180mn lb in annual reactor demand). In other words, the spot price of uranium is still trading at around half the cost of marginal production.

Our investment thesis was that utilities would belatedly move to secure supply of uranium for their nuclear reactors (from 2022, the fuel coverage ratios of the US utilities in particular start to decline), and this would push up the price of uranium towards the marginal cost of production.

If speculators also got involved – as they did during the last great bull run of 2003-2007 – prices might overshoot to the upside. And as the fundamentally tight supply-demand balance was reflected in a higher price of yellowcake, we expected the stock prices of the uranium miners to rally strongly.

The Bull Market in Uranium Junior Mining Stocks (Although Not in Uranium)

In reality, however, what we have seen over the last six months is a massive rally in the uranium miners and juniors despite a decline in the price of uranium itself!

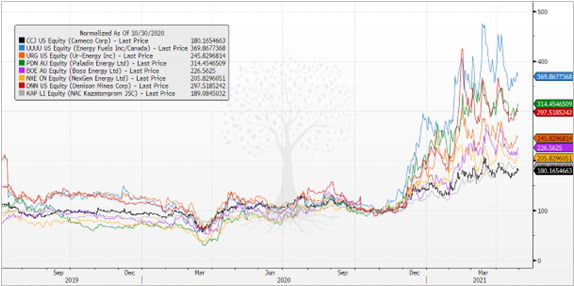

The share prices of various uranium miners and juniors have surged anywhere between +80% and +400% since last November (Figure 2). The gains since the March 2020 have been even more dramatic, with gains for these stocks ranging between +200% and +900% since the lows of last year. As a result, many of these companies – which six months ago were trading at a large discount to NAV – are now trading at a multiple thereof.

This enormous rally in the uranium miners appears to have been catalysed primarily by a shift in investor perspective regarding nuclear energy. A critical mass of retail and institutional investors now seems to have realised that international carbon reduction goals will be impossible to achieve without a significant contribution from nuclear power (barring the development of some other transformative energy source). The shift in viewpoint on atomic power was no doubt aided by the US Democratic Party explicitly including nuclear power in its platform for the presidential election last year, for the first time since the 1970s.

A review of excited commodity twitter postings and new sell-side research reports indicate that the broader investment community – few of whom had any interest in yellowcake when stocks were at bargain basement prices one year ago – are now very much aware of the tight supply-demand dynamics in uranium and the ‘ESG’ credentials for nuclear power. The uranium sector is also very small in terms of listed, investable stocks and market cap, so even a small positive change in flows can have an outsized impact on stock prices.

Sentiment has thus become much more bullish. A recent public interview with a uranium buyside specialist promised viewers that “this is the most asymmetric trade…” that he has “ever seen”. Recent uranium investor days, hastily convened by resource brokers who have rushed to appoint new uranium sector analysts, are experiencing record attendance levels!

Last year, the risk-reward for going long uranium miners and juniors may have been very attractive. Leaving the hyperbole aside, however, are uranium miners really still such a good opportunity now that stocks have rallied so much?

Weighing up the pros and cons, we arrive at a slightly more cautious view…

In the minus column, the valuations for many uranium stocks are clearly much higher than they were just a few months ago, especially considering that the spot and term prices for uranium have barely budged over the last two years. Some bulls point out that given the scarcity of listed uranium miners (especially those with good deposits and competent management teams), uranium miners have the potential to trade at huge premiums to NAV, as in the last 2003-2007 upcycle.

Even they concede, however, that from a fundamental perspective it is difficult to justify the rallies we have seen in some of the lower quality juniors (some of which have problematic deposits and high costs, and may not even get into production at all in the 2020s). We conservatively estimate that most uranium miners and juniors are now pricing in U3O8 at US $40-80/lb, a substantial premium to current spot and term prices. If these uranium prices are not realised soon, this poses a risk to elevated stock prices.

In the plus column, the supply-demand balance has tightened even further during the last year because of mine closures and suspensions. Rising Covid-19 case numbers in the world’s largest uranium production areas, Kazakhstan and in Saskatchewan, might yet still threaten mine production. Inventories have also fallen thanks to spot purchases by miners (to deliver into existing contracts and for speculative reasons). This increases the likelihood that when the utilities finally start to sign term contracts for uranium, prices will increase rapidly.

Reflexivity in Action

From our perspective, the most unexpected recent development in the uranium market has emerged as a result of the disconnect between the declining uranium spot price, and the resurgent stock prices of the uranium miners and juniors.

The development we are referring to is that some of the juniors have started to take advantage of their elevated share prices to issue more shares to buy physical uranium in the spot market.

One expects the ‘uranium holding companies’4 to issue shares when trading at a premium to NAV and use the proceeds to buy physical uranium, as this is by definition NAV-accretive. What is more surprising is that uranium mining juniors have also started to play the same game. UxC has reported that in the last few weeks, uranium juniors have purchased as much as 10.5mn lb of physical uranium. These companies include Denison (which paid US $74mn for 2.5mn lb of U3O8), Uranium Energy Corp, Boss Energy, and enCore Energy.

The justification given by some of these firms is that they can always sell the physical uranium when the price “inevitably rises” to fund mine capex requirements. Apparently, if a miner holds yellowcake, it also “de-risks” their projects in the eyes of future utility customers. This is because if there is a delay in commissioning a mine, then the miner can still deliver uranium out of its inventory to the utility (rather than uranium produced from the new mine).

The risk to this strategy is of course what happens if uranium prices do not rise. This might happen if a nuclear accident suddenly kills off demand (similar to the Fukushima tragedy of 2011), or if state-owned uranium miners lose their supply discipline and ramp up production at the expense of prices. In that case, the juniors would be stuck with depreciating yellowcake assets with high storage costs.

These acquisitive juniors – who have just been through a decade-long bear market – have rationally calculated that with their stock prices at high levels and uranium cheap, it is worth the risk! Bitter experience dictates to weary management teams that it is best to raise as much money as possible while the capital markets are open for business. If the justification is to spend some of this capital on uranium, so be it.

Investors, however, should investigate very carefully the likelihood that each of these juniors will actually be capable of mining uranium. Panah only expects one of the yellowcake-buying juniors listed above to go into production before 2025, and the majority of projects owned by a couple of these companies probably never will! Rest assured that such considerations are reflected within our portfolio construction.

The impact of the current market optimism surrounding uranium miners is also an interesting example of ‘reflexivity’ in action.5 Investors have become bullish about the uranium sector and so have bid up the price of junior miners. This has enabled these companies to raise capital at higher valuations, and some of this money has been used to purchase cheaper physical uranium. This has in turn helped to draw down uranium inventories, thus tightening supply.

This is in effect a positive feedback loop which has led to improved sector fundamentals, thereby justifying higher valuations for uranium stocks!

(Living up to) Great Expectations

For the share prices of uranium miners to remain supported at current levels, however, it will likely be necessary for uranium spot and contract prices to move higher in the near future. If not, there is a risk that recent investors in the sector will be frustrated, leading to a market correction in uranium-related equities.

If there were a short-term sell-off as speculative flows go into reverse, this would likely present a buying opportunity, as the medium- to long-term outlook for the sector remains attractive. The US and Europe are ‘going green’ and China is still intent on building more reactors.6

In any case, given that idled uranium mines now appear to be coming back into production,7 this likely means fewer spot market purchases from the miners in 2021. Any further substantial boost to uranium prices thus probably requires an acceleration in contracting activity from the utilities.

Unfortunately, we do not see this as a strong possibility in the coming months. Utilities are still focused on operating safely during the pandemic. Seasonality and other factors suggest that it might be later in 2021, at the earliest, before the utilities increase their contracting activity.

Utility buyers reportedly see the current market as “frothy”, and are not overly worried about a tight supply-demand situation. They note that there has been no pick-up in uranium prices following the latest spot purchases by junior miners. To them, this suggests that inventories and supplies are adequate for now. That hypothesis will not be tested, however, until the utilities start to request more supply proposals and sign term contracts!

Given these latest developments, we have shifted Panah’s uranium exposures. This has involved trimming various holdings on strength, thereby reducing overall exposure. Our profit-taking has been focused on some of the junior miners, which have attracted more speculative flows, allowing share prices to rise to levels which are difficult to justify with reference to the fundamentals.

In some cases, we have probably been too early to take profits, as the flows have continued and stock prices to rise. Nevertheless, we believe this to be the most prudent course of action. We will continue to take action based on fundamental analysis rather than a hope that liquidity continues to drive speculative flows.

We prefer to focus on the handful of companies which are either in production (and are thus generating cash flows and dividends), are likely to be in production soon (thanks to project readiness and balance sheet strength), and a few smaller companies which for idiosyncratic reasons are not yet discounting a higher uranium price.

In our view, the uranium holding companies also still offer reasonable value when trading at close to ~1.0x NAV, as the uranium held by these vehicles should become more valuable as a tightening supply-demand balance pushes prices higher over time.

On the other hand, we now see little value in most US-listed uranium stocks, which seem to have been bid up to unjustifiable levels on the back of thematic interest in uranium and other commodities such as rare earth metals. Expectations around a US uranium stockpile have also helped to buoy sentiment. While further flows might yet be able to levitate stock prices, any disappointment might lead to sharp losses. Caveat emptor!

While we are constructive on the uranium sector in the medium-term, at present we see more value in other sectors. In resources, for example, we note that the gold miners have been in a correction since last summer; there appear to be more overlooked opportunities in this area.

Naturally, we also see plenty of idiosyncratic, single-stock opportunities available in the other markets where Panah is active, and we will continue to pursue these.

Thank you for reading.

Andrew Limond

The original source material has been edited for spelling, punctuation, grammar and clarity. Photographs, illustrations, diagrams and references have been updated to ensure relevance. Copies of the original quarterly letter source material are available to investors on request.

For our original articulation of the investment case for uranium, see the Panah Fund letter for Q1 2019 (pp.4-12) and the following Seraya Insight: ‘Anticipating the End of the Downcycle in a Radioactive Sector’.

The spot price of uranium is an imperfect benchmark, as it reflects a price at which a handful of less price-sensitive producers dispose of a small volume of non-contracted yellowcake. The vast majority of uranium is bought by the utilities via long-term contracts with the miners, at prices and on conditions which are more opaque, but are (almost) always at a premium to the spot price.

The major listed uranium holding companies are Yellowcake and Uranium Participation Corp. In February, Yellowcake – trading at a premium to NAV – raised US $140mn, part of which was used to exercise its option to buy 3.5mn lb of uranium from its ‘mining partner’, Kazatomprom. Uranium Participation Corp is yet to take advantage of its NAV premium to issue shares, although it has recently announced a change in management and business structure.

In the words of George Soros, reflexivity is the phenomenon where, in the real world and the markets, “participants’ views influence the course of events, and the course of events influences the participants’ views. The influence is continuous and circular; that is what turns it into a feedback loop.”

The military implications of China’s nuclear power push are just starting to be understood.

See, for example, the recent announcement from Cameco that it would restart mining at the massive Cigar Lake mine in April, despite rapidly rising Covid-19 case numbers in Saskatchewan.