Anticipating the End of the Downcycle in a Radioactive Sector ☢️

The investment case for uranium

This Insight is not investment advice and should not be construed as such. Past performance is not predictive of future results. Fund(s) managed by Seraya Investment may be long or short securities mentioned in this Insight. Any resemblance of people or companies mentioned in this Insight to real entities is purely coincidental. Our full Disclaimer can be found here.

This Insight is an extract adapted from the Panah Fund letter to investors for Q1 2019.1

In a recent letter, we described the anatomy of a typical capital investment cycle. We also described various examples of how cyclical analysis has proven relevant.2

In this letter, we describe in more detail the investment case for an out-of-favour commodity that we believe is coming close to the end of a decade-long downcycle. Uranium will be essential for building out emission-free baseload power generation capacity in the coming years.3

TABLE OF CONTENTS

A Brief History of Uranium and Nuclear Power: from Genesis to the End of the Cold War

After the Cold War: ‘Megatons to Megawatts’, the 2003-2007 Boom, Kazakhstan and Fukushima

The Investment Case for Uranium: the Supply-Demand Imbalance and ‘Mobile’ Inventories

The Geopolitics of Uranium and the Latest US Section 232 Investigation

A Brief History of Uranium and Nuclear Power: from Genesis to the End of the Cold War

Uranium minerals first became known to mankind several hundred years ago. They were a then unneeded by-product of the silver mines near Joachimsthal in the Ore Mountains (on the modern-day Czech-German border). It was only in 1789 that Martin Klaproth succeeded in isolating uranium from pitchblende.4 He named the new element after the planet Uranus.

Uranium’s original commercial use in the 19th century was limited, as a yellow pigment in glass and porcelain. Up until the next century, the only major source of uranium was Joachimsthal, and pitchblende from this mine was used by Marie and Pierre Curie to isolate the element radium in 1898.

In the early 20th century, radium was a more commercially valuable element than uranium, as it was used for medical applications and in luminous paint (for watch and clock faces). Thanks to the Curies and to scientists such as Henri Becquerel, Ernest Rutherford and Frederick Soddy, major advances in physics and chemistry in the late 1800s and early 1900s led to a greater understanding of radioactivity.

It was not until the start of the Second World War (‘WW2’), however, that there was a large increase in worldwide research into the practical applications of uranium. This was primarily for weapons-use and for electricity generation.

After the entry of the US into WW2 in 1941, the Allied focus shifted to developing a bomb which could harness the power of the atom. Much of the uranium for initial research was sourced from Shinkolobwe in the Belgian Congo (now the Democratic Republic of the Congo), from the Eldorado radium (pitchblende) mines near Great Bear Lake in Canada, and then from vanadium deposits in the Southwest of the US.

As the U-boat threat in the Atlantic increased, US and Canadian uranium became more important. The success of the Manhattan Project paved the way for the terrible power of the new atom bomb to be unleashed in Hiroshima and Nagasaki in August 1945. While the bombs may have hastened the end of the Pacific War, the world would never be the same again.

The Cold War followed hot on the heels of WW2. In 1949, the Soviet Union became the second nation to demonstrate that it too had the atom bomb. Britain followed soon after in 1952. In 1952 and 1953, the US and the Soviet Union detonated the world’s first hydrogen bombs.

At the same time, efforts were being made to harness nuclear power for peaceful use. Following the world’s first experimental production of electricity from a nuclear reactor by the US Atomic Energy Commission (‘AEC’) in 1951, President Eisenhower proposed an ‘Atoms for Peace’ program in 1953 which set the scene for the development of civil nuclear energy in the US.

The world’s first grid-connected nuclear power station came online in 1954. This was not in the US, however, but rather at Obninsk in the Soviet Union. Britain followed in 1956 with the Calder Hall plant, used to generate power and plutonium. The first commercial nuclear power plant in the US came online in 1957 at Shippingport in Pennsylvania.

In 1960, Westinghouse developed the first commercial pressurised water reactor (‘PWR’) and General Electric launched the first boiling water reactor (‘BWR’). However, it was not until the end of the 1960s that electrical utilities started to place orders for the construction of >1,000 MWe PWR and BWR reactor units.

Given the dual uses of uranium for power and defence, the post-WW2 consensus was that it was vital to control supplies of the metal. The US AEC was established in 1946, and the organisation’s first priorities were to monopolise existing supplies of uranium and to find new sources of the metal quickly.

In 1948, the AEC became the only legal purchaser of US-mined uranium. To incentivise more production, the AEC announced a guaranteed price for certain types of uranium ore and a bonus for high-grade deposits.

This AEC decision kick-started an early-1950s uranium rush in the US Southwest, especially in the ‘Four Corners’ area of Arizona, New Mexico, Utah and Colorado. By most accounts, this was the largest ever resources-rush in history.5

Fortunes were made and lost overnight, capturing the public imagination.6 Hollywood made films. Comic-books ran adverts for new, portable Geiger-Müller counters which retailed for US ~$25. Board games were sold. Uranium samples were included in children’s science kits. What’s more, the uranium rush had all been started by the US government!

This also meant, however, that the government could take it all away. By 1960, the AEC had stockpiled enough uranium to meet the nation’s needs for the foreseeable future. As the government scaled back their purchases, the uranium boom turned to bust.

The AEC purchases had also extended to Canada, catalysing a uranium boom in the 1950s as miners scrambled for the country’s rich deposits. By the 1960s, however, the Canadian miners required national support as US demand fell. The nascent South African and Australian uranium-mining industries developed along a similar trajectory in the 1950s-60s. It was only in 1970, however, that the extremely large and rich uranium deposits of the Northern Territories were discovered in Australia, sparking a national debate on whether to develop these resources.

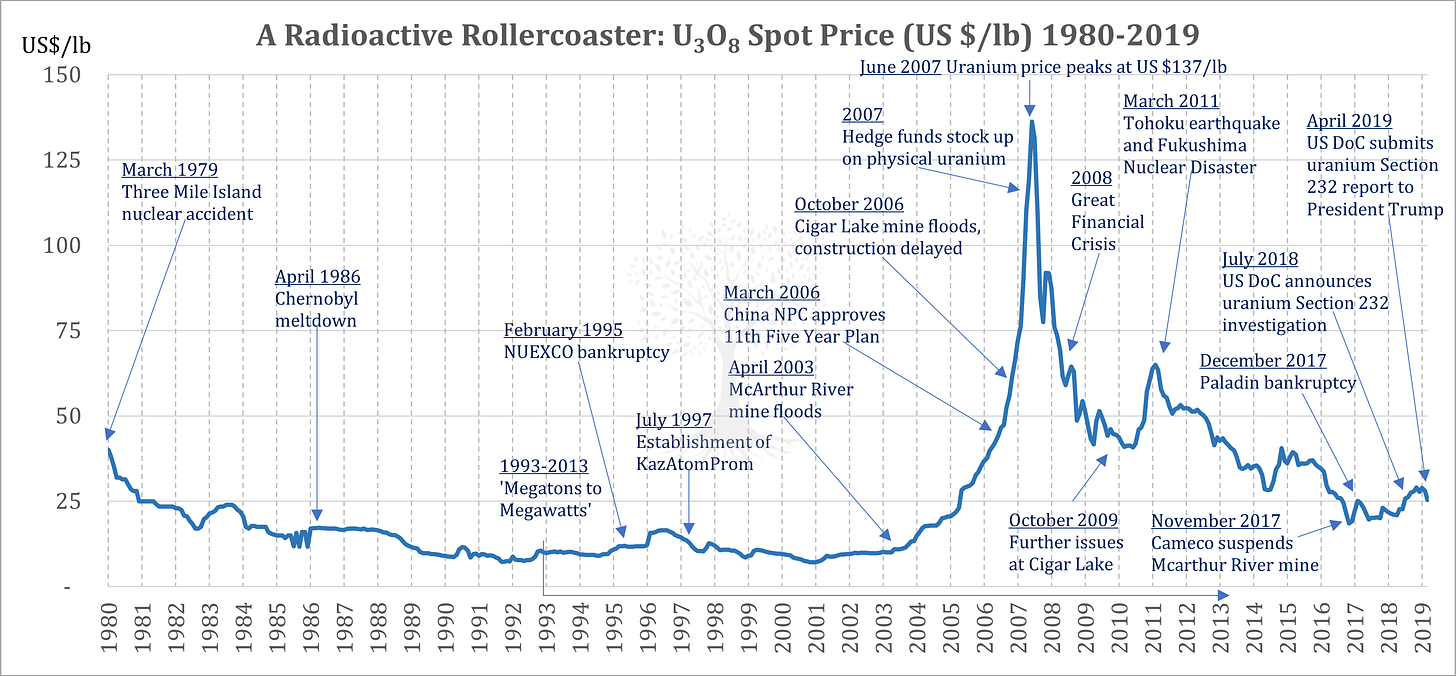

The debate about nuclear power became more relevant in the 1970s, as it was then that uranium demand for the world’s growing reactor fleet finally started to increase. This demand coincided with a sharp rise in global energy prices as a result of the first oil crisis. At the same time, a cartel consisting of governments and uranium miners (in Canada, Australia, South Africa, France, and the UK) conspired to restrict supply.7 As a result, the price of U3O88 jumped from well below US $10/lb in 1973 to above $40/lb by 1976, where it remained for most of the rest of the decade.

In March 1979, the partial meltdown of a reactor at Three Mile Island, Pennsylvania and the subsequent radiation leak prompted a public backlash against nuclear power and led to increased regulation. The accident also contributed to a slowdown in global nuclear reactor construction, and within two years the price of uranium had halved to below US $20/lb.

In April 1986, the world’s worst ever nuclear accident occurred at the Chernobyl Nuclear Plant. Explosions in the #4 reactor core led to a fire which dispersed large quantities of radioactive isotopes into the atmosphere. Radioactive material was carried by the wind to places as far away as Scotland and Scandinavia.9

The accident prompted serious concerns about nuclear fission among the public. Rising safety costs and an increasingly hostile public reaction led to a sharp fall in nuclear power plant construction for much of the next two decades following the accident.

After the Cold War: ‘Megatons to Megawatts’, the 2003-2007 Boom, Kazakhstan and Fukushima

The end of the Cold War brought further complications for uranium as the superpowers started to cut their nuclear weapon stockpiles. In 1993, Russia and the US signed the ‘Megatons to Megawatts’ agreement, whereby Russia would sell all uranium in excess of defence needs to the US Department of Energy (‘DoE’) over the subsequent 20 years.

During this period, the DoE purchased from Russia nearly 15,000t of low-enriched uranium (equivalent to more than 20,000 nuclear warheads),10 thereby bringing ~23mn lb of U3O8 onto the market each year.11 This additional secondary supply source weighed heavily on the market for much of the period. It was also one of the proximate causes for the 1995 bankruptcy of NUEXCO, hitherto the world’s largest uranium trading firm.

Uranium prices only started to recover in 2003, moving north of US $20/lb for the first time in two decades following the April flooding of Cameco’s flagship McArthur River mine in Saskatchewan, Canada. McArthur River was the largest mine in the world at the time, accounting for ~18% of global output.

In March 2006, China’s National People’s Congress approved the country’s 11th Five Year Plan, which envisaged a much larger role for nuclear power in the country’s future energy plans. This gave a further boost to the uranium price as investors anticipated a nuclear renaissance.

By October 2006, when flooding delayed construction at Cameco’s new flagship Cigar Lake project in Saskatchewan (expected to produce ~17% of world output), the price of uranium had already reached more than US $50/lb.

This further supply disruption catalysed a short-lived bubble as speculators piled in to buy uranium futures and even physical stocks of the yellow metal. The jump in uranium prices transformed the economics of uranium extraction for marginal miners.

Stocks such as Paladin (with assets in Namibia and Malawi) surged as much as ~134,000% from the mid-2003 low to the early 2007 highs! By late 2007, hedge funds were said to own as much as 25% of the physical uranium market.

The price of uranium, however, had already peaked in June 2007 at US ~$137/lb. The summer of 2007 marked the start of the Great Financial Crisis, which culminated in the bankruptcy of Lehman Brothers in September the following year.

By the end of 2008, the price of uranium had fallen back to US $50/lb, decimating the stock prices of the uranium miners in the process. The uranium price continued to drift down into early 2010. Following further delays at Cigar Lake, there was a small lift in the price of uranium from mid-2010 to in early 2011. However, this recovery was destined to be short-lived.

On 11 March 2011, a magnitude 9.0 earthquake struck 130km off the coast of Sendai in the Tohoku region of Japan. The resulting tsunami reached heights of up to 40m and travelled as far as 10km inland. More than 15,000 people lost their lives in the terrible disaster.

The tsunami also washed over a seawall at the Fukushima nuclear plant, overwhelming the power supply and cooling systems of three Fukushima Daiichi nuclear reactors. The subsequent meltdowns were the worst nuclear incident since the Chernobyl disaster, prompting mass evacuations in northeast Japan.

Public opinion once again swung firmly against nuclear power, especially in Europe where concerns over nuclear safety and long-term disposal of nuclear waste came to the fore. As optimism over renewable energy increased, Germany closed half its reactors and made plans to shut down all the country’s nuclear plants by the early 2020s. France also announced it would reduce the share of nuclear in the country’s electricity generation mix from 75% to 50% by 2035.

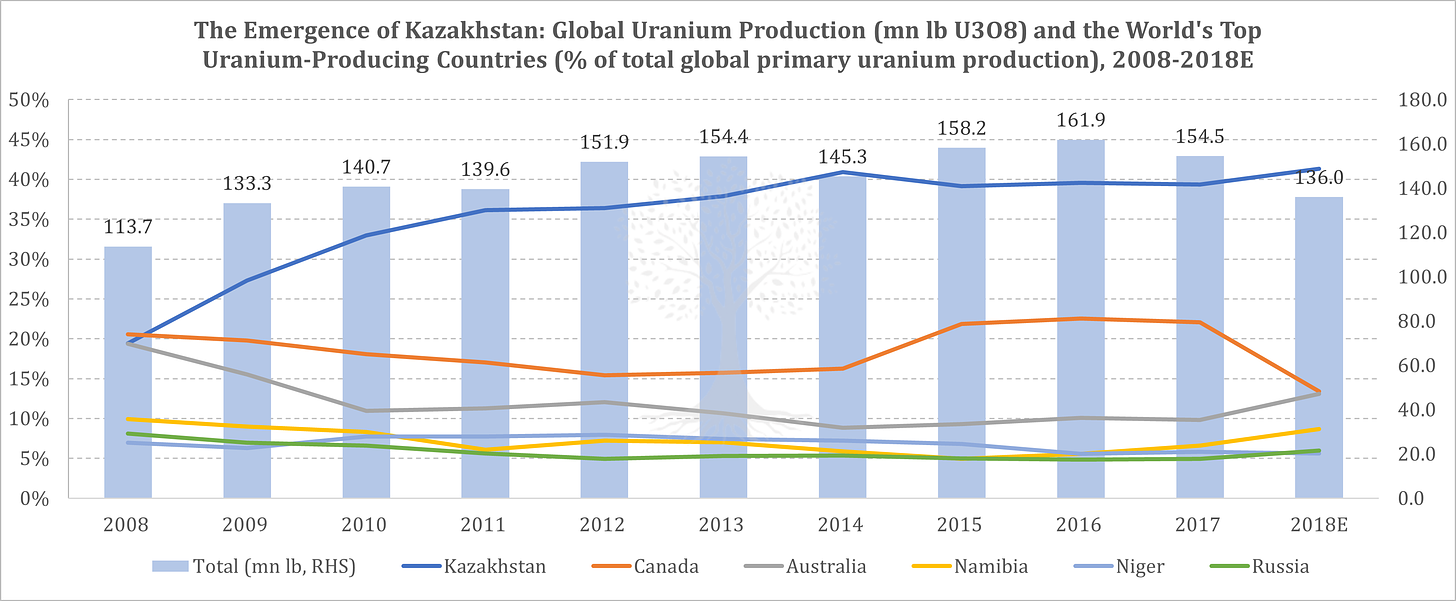

Even as demand for nuclear power remained subdued, a new uranium mining powerhouse had quietly emerged. Kazakhstan already had a long history as a uranium-producer and nuclear test-site during the Soviet period, owing to its abundant and cheap supplies of the metal.

In 1991, after the fall of Soviet Union, Kazakhstan became a republic under President Nazarbayev and gained more control over its resources. However, it took time for the new country to find its feet after independence, and uranium production fell by more than 75% from 1991 to 1997.

In 1997, a new national uranium-mining champion – KazAtomProm – was formed from a collection of Soviet-era mines. After overseas markets opened for Kazakh uranium sales from 2000, the company started to ramp up production. In 2001, Kazakhstan’s uranium output stood at just ~2,000t, a fraction of global production, but it was set to grow fast.

The establishment of joint ventures with foreign firms and the application of in-situ leach mining techniques allowed Kazakhstan to quadruple its output by 2008, making the country one of the world’s top three uranium producers along with Canada and Australia (each with ~20% of global output).

Kazakhstan continued to increase production in subsequent years, first becoming the world’s #1 uranium producer in 2009 (Figure 10). By 2016, the country had further increased uranium output to more than ~24,500t, a twelvefold increase since 2001 and equivalent to ~41% of global production.

The global uranium market was already suffering from lacklustre demand following the Fukushima disaster, and the overwhelming supply glut from Kazakhstan proved to be almost too much to bear. By the end of 2016, the price of U3O8 had once again collapsed to under US $20/lb, well below the cost of production for all but the world’s lowest-cost mines.

Indeed, this price was too much for some miners to bear. Paladin – the ‘hottest’ uranium stock in the 2003-2007 boom – filed for bankruptcy in late 2017. Rather than mining the metal themselves at higher costs, a few surviving uranium miners found it cheaper to buy U3O8 in the spot market and deliver this into their long-term (and higher price) contracts with the utilities, most of which had been signed in better times.

The Investment Case for Uranium: the Supply-Demand Imbalance and ‘Mobile’ Inventories

Demand

The bleak outlook for uranium has been reported widely. Indeed, those who subsist on a diet of Western newsprint may be forgiven for thinking that nuclear power is dead. Mainstream media reports have tended to focus on mothballed reactors and delayed restarts in Japan, financial and operating difficulties for plants in the US, and a planned phase-out of nuclear power in Europe.

This Western-centric view obscures the burgeoning demand from the Emerging World. While it is true that some countries, such as France and Germany, are moving away from nuclear energy, this is not the case elsewhere.

China plans to give nuclear power a ~10% share in the country’s total electricity generation mix by 2030, which means increasing capacity fourfold from 39 GW now to 120-150 GW by then. (This is part of the country’s attempt to diversify away from its heavy dependence on coal). India plans to more than triple its nuclear capacity from 6.8GW to 22.5GW over a similar period. Demand in the Middle East and Russia is also set to grow.

Nuclear power remains important for power generation in the US, where it accounts for ~20% of total generation and ~56% of emission-free electricity. While some older reactors are due to close, more new ones will be built.

In summary, net demand for uranium looks set to increase in the next decade, driven primarily by Asia.

Supply

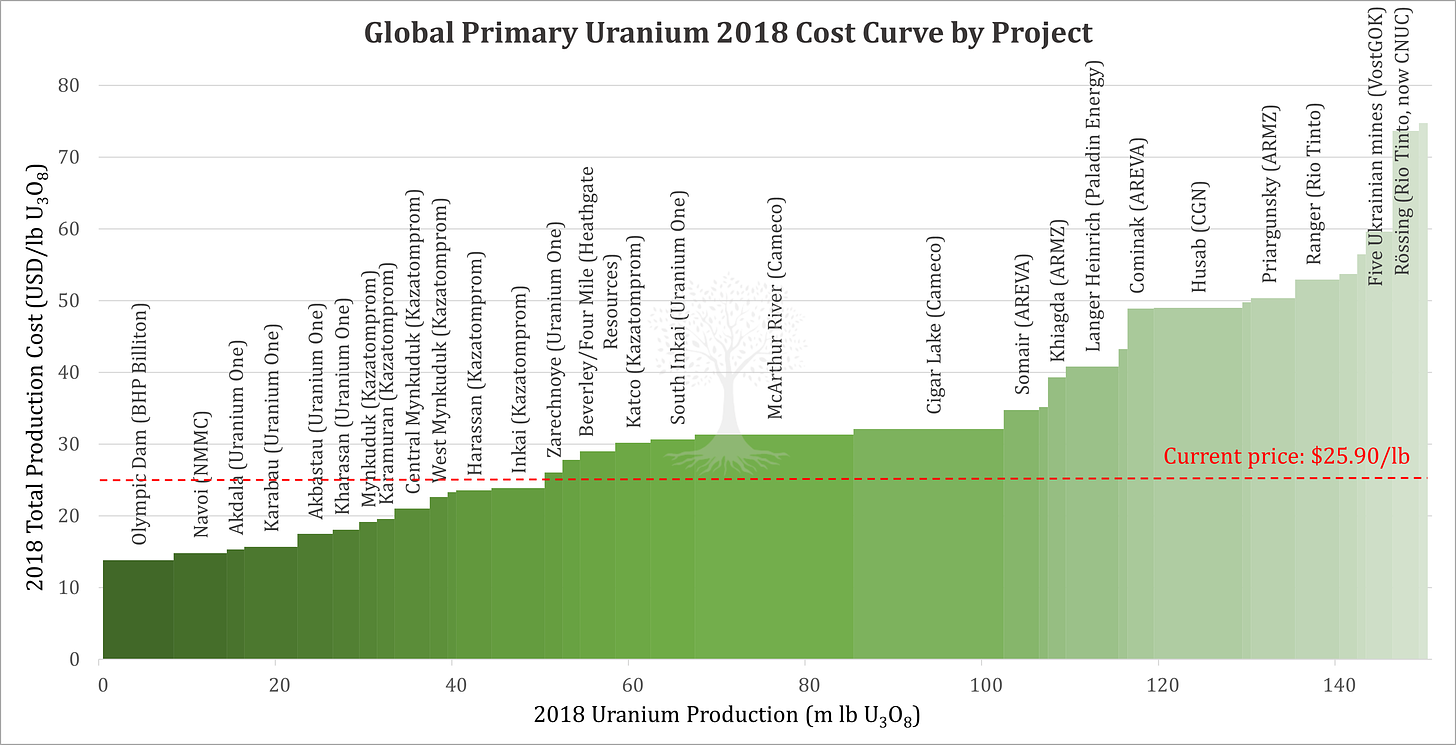

The emergence of Kazakh uranium over the last two decades has undoubtedly been a major factor in driving down the price of U3O8. Recently, however, the supply situation has started to improve. The low-price regime now means that many uranium miners around the world can no longer produce economically (Figure 12).

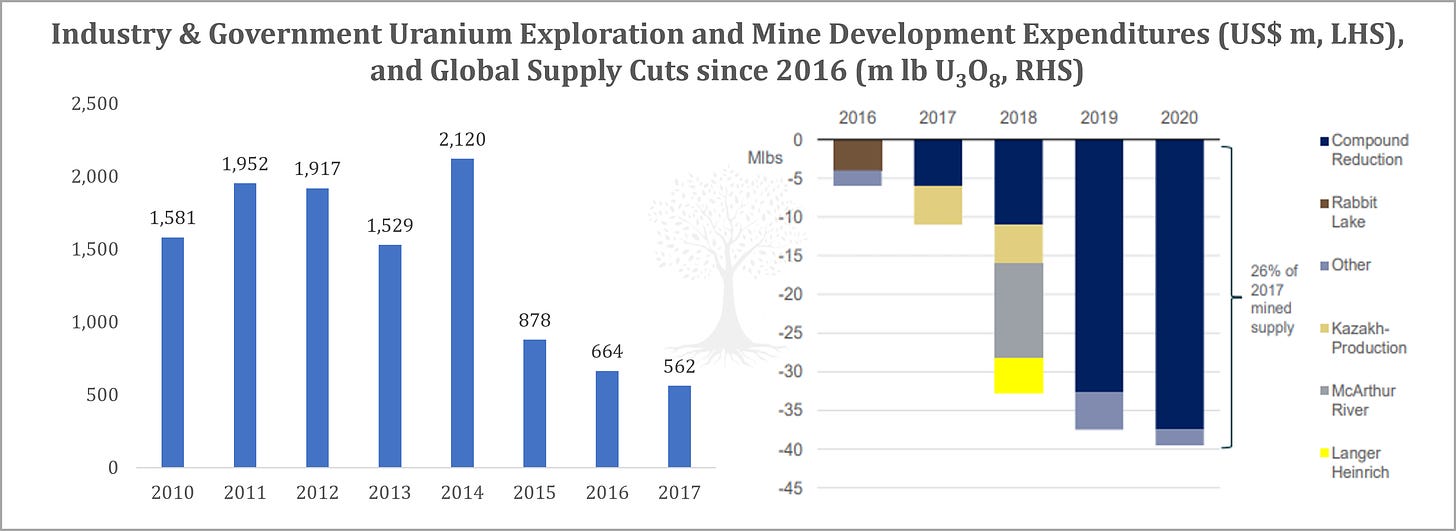

Some companies have already failed, while the survivors have cut back production and exploration spending (Figure 13).

The supply story started to change with the 2016 suspension of Cameco’s Rabbit Lake mine. In 2017, Kazatomprom then announced two cuts to planned output increases. Paladin’s bankruptcy in 2017 meant a cessation of production from the company’s Langer Heinrich mine. The most significant closure was then announced in November 2017: the 10-month suspension of Cameco’s McArthur River mine - the single largest mine in the world. In July 2018, this shutdown was extended indefinitely.

By end-2018 it had been announced that a combined ~39mn lb in global uranium output cuts would come into effect by 2020, equivalent to ~26% of end-2017 production (Figure 13).

Secondary supply is also an important consideration for the uranium market.

Secondary supply can come from a variety of sources, including sales from government inventories (e.g., the above-mentioned ‘Megatons to Megawatts’ program), ‘underfeeding’ and tails re-enrichment by uranium enrichers,12 reprocessing,13 and sales of commercial inventories (i.e., by miners and financial intermediaries).

Given the complexities involved, it is beyond the scope of this letter to cover this topic in detail. In aggregate, however, we forecast that secondary supply is expected to decline in coming years, driven mainly by lower underfeeding.

Inventories

Elevated levels of global uranium inventories might also seem to be a concern at first glance. Most inventory estimates are high, although the exact numbers vary massively depending on the source. There is said to be as much as 1.3-1.8bn lb of U3O8 in inventory around the world – equivalent to 7-9 years of current annual demand – spread among utilities, governments, financial entities and producers.

Much of the uncertainty revolves around the amount of uranium in strategic stockpiles. Such high levels may seem alarming at first glance, until one adjusts for inventory that is not commercially viable (e.g., low-grade, depleted US DoE tails) as well as inventory which is not ‘mobile’ (i.e., supplies which unlikely to come onto the market, such as strategic Russian and Chinese stockpiles, as well as pre-fabricated Japanese fuel rods which can only be used in specific nuclear plants).

China is important as the country is currently thought to hold ~25-30% of global inventories. This is much more than the country’s current requirements, but the policy has been to build up stocks in anticipation of the coming nuclear roll-out, while prices are still cheap!

As the development of domestic sources of uranium have disappointed, China has also been increasing its exposure to overseas operating mine assets. The latest acquisition was CNUC’s purchase of Rio Tinto’s majority stake in the Rössing Mine, Namibia in November 2018. This follows CGNP Corp’s earlier acquisition of the nearby Husab mine (expected to be the second largest mine in the world). To meet its long-term nuclear goals, China is expected to continue buying uranium and uranium mines.

Ex-China, the world’s utilities hold around ~3.5 years of supply, which is broadly in line with historical norms. While total global inventories are high, we estimate that at present there may be only 80-100mn lb of total mobile inventory (half from Japan, and half from producers and financial intermediaries), which is just a fraction of total global inventory levels. Moreover, we anticipate that these mobile stocks are unlikely to come loose until uranium prices rise to higher levels.

As a result of mine closures and declining secondary uranium supply, we estimate that in 2018, the uranium market went into deficit for the first time in more than a decade. This is significant, as demand is set to rise steadily but it typically takes a long time to permit and build a new mine. Restarts of idled mines are also time-consuming and costly.

As a result, the price of uranium rose during 2018, recovering from a low of US $20/lb in April to more than $29/lb at the end of the year, before dipping into early 2019.

It has not only been the tighter supply-demand dynamics which have helped to support the price of uranium. The spectre of geopolitics is once again looming large over uranium, and the stakes are high.

The Geopolitics of Uranium and the Latest US Section 232 Investigation

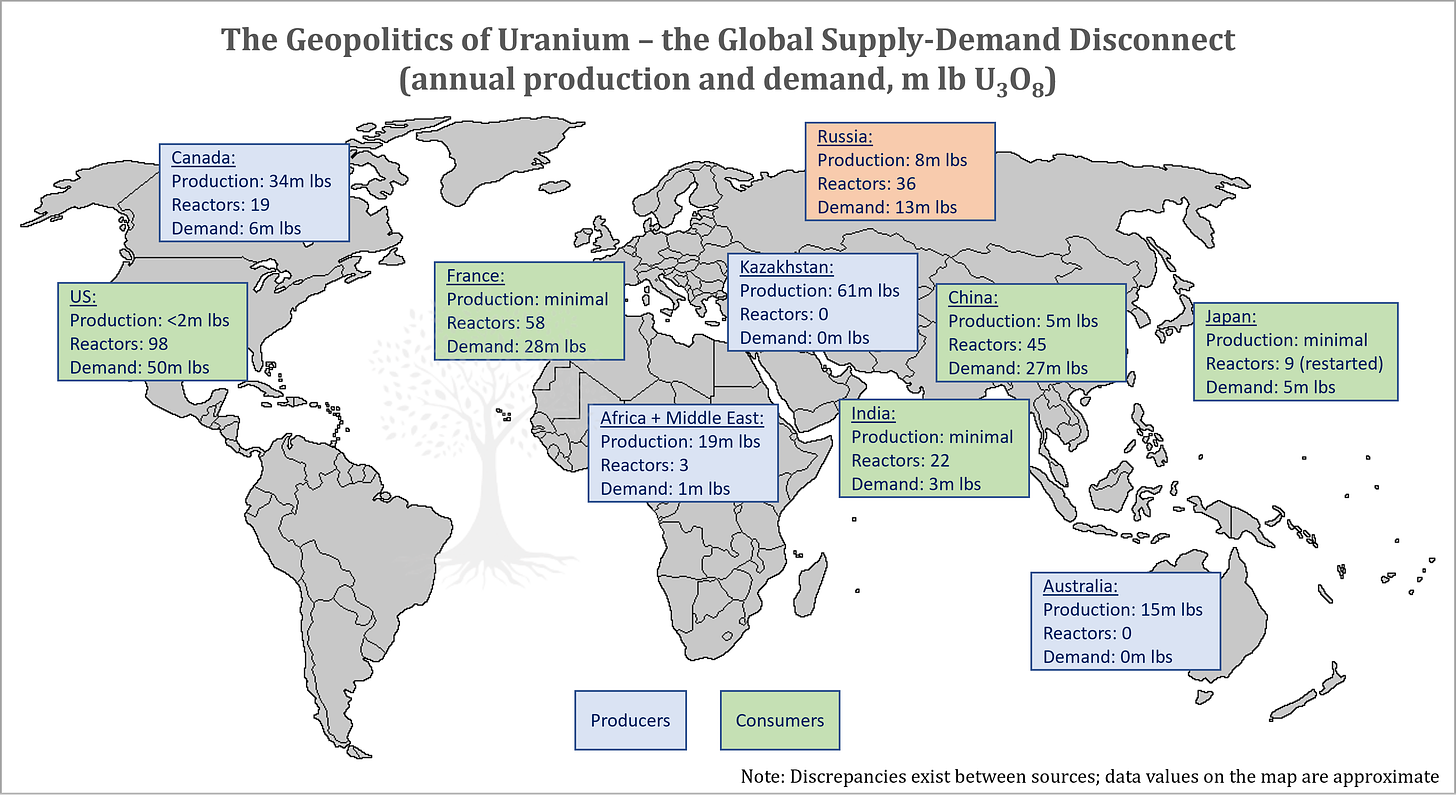

One distinctive feature of the global uranium market is the geographical disconnect between producers and consumers (Figure 14). Kazakhstan, Canada and Australia are collectively responsible for ~70% of global output (although of those countries, only Canada has a modest amount of nuclear power generation capacity.)

The US is currently the world’s largest nuclear power generator, but less than two percent of its uranium needs are sourced domestically. France and China are #2 and #3, but France has no domestic uranium production and China has little. Only Russia remains roughly self-sufficient in the metal (and can easily source additional supplies from Kazakhstan and Uzbekistan).

To complicate matters even further, not only has the US lost self-sufficiency in uranium mining since the 1980s, it has also lost the lead in some elements of uranium processing and nuclear technology.

Uranium alone cannot power a nuclear plant; BWR and PWR reactors require natural uranium with ~0.7% U-235 content to be enriched to ~4% before it can be used for fuel. In enrichment, Russia is dominant – Tenex (a wholly-owned subsidiary of Rosatom) is set to control nearly half of the world’s uranium enrichment capacity by 2020. While Western Europe (Orano14 and URENCO) still control around one-third of global enrichment capacity, China (CNNC) is coming up fast. The US lags behind with only one URENCO site in New Mexico.

Before Donald Trump was elected President of the US, most investors had never heard of the ‘Trade Expansion Act of 1962’. That changed in April 2017, when the Department of Commerce (‘DoC’) launched an investigation into the impact of steel and aluminium imports on US national security under Section 232 of the Act.

Under Section 232 rules, after commencing an investigation, the DoC has 270 days to submit a report to the President outlining any threat to national security from the foreign imports in question. The DoC report should also propose any appropriate remedies, which may be in the form of tariffs, domestic quotas, or other remedies. The President must then decide on what course of action to take, if any.

In March 2018, as a result of the steel and aluminium investigation, President Trump imposed respective tariffs of 25% and 10% on the metals. Shortly afterwards, in May 2018, the DoC initiated a Section 232 investigation on autos and auto-parts.

Not long after, on 18 July 2018, the DoC accepted a petition from two of the few remaining US uranium-producers to launch a Section 232 investigation into imports of uranium ore and products. (More recently, in March 2019, a DoC Section 232 investigation into titanium sponge imports began.)

Last week, on 14 April 2019, the DoC submitted its Section 232 report on uranium to the President. The findings of this report have not yet been published or made public. President Trump has 90 days from the date of the report submission, until mid-July, to decide on an appropriate course of action.15

The US nuclear power generators are of course opposed to any tariffs or quotas that would increase US uranium prices. In reality, though, uranium only accounts for a low single-digit percentage of the operating costs of the US nuclear plants. For that reason, even a doubling or tripling in the uranium price would be unlikely to cause serious cost issues for the utilities. The utilities do, however, command powerful lobbying power in Washington, and thus the outcome of the Section 232 appeal on uranium imports is uncertain.

Investment Implications

The original Section 232 uranium petitioners are pushing for a quota system whereby domestic utilities would have to purchase at least 25% of their uranium requirements from domestic mines. If such a quota system were to be introduced, it would likely have to be phased in over several years (given limited amounts of US uranium output at present, and the time required to ramp up production).

Such a quota would also imply a bifurcated global pricing system, with US domestically-mined uranium prices at a premium (likely at least US $50/lb to start, so roughly double current global spot prices) and the rest of the world at a discount. The obvious immediate beneficiaries of any Section 232 quota would thus be the US marginal uranium producers.

Even if President Trump decides to take no action on uranium imports, any decision on Section 232 would allow an important market-clearing process to take place. Many utility companies – in the US and further afield – have delayed signing long-term uranium procurement contracts (which are typically at a significant premium to the spot price) as they await the results of the Section 232 investigation.

Indeed, uranium contract coverage rates for the US utilities are set to slip from >80% in 2019 to just ~40% in 2022.16 So, no matter what President Trump decides, there will likely be a flurry of activity to sign new agreements with the miners in the second half of 2019 and beyond.

Such activity will in turn likely serve to underline the new reality that supply discipline has finally prevailed among the miners, and that uranium supply-demand dynamics are now at their tightest levels in more than a decade. This should be positive for the global price of uranium, which in turn would likely cause stock prices of uranium miners to rise sharply.

There are of course risks to this investment thesis. Any factor which derails the Chinese commitment to nuclear power (whether a nuclear accident or a financial crisis) would be problematic. If Kazatomprom were once again to start increasing its output, then this would likely place a damper on prices.17 Finally, if inventories were to come loose from unexpected sources, this would also likely have a negative impact on the price of uranium.

On balance, however, we believe that the risk-reward for uranium stocks is currently at the most attractive levels since 2003. For most investors, however, there are few choices. Cameco and Kazatomprom are the only listed large uranium miners, with market capitalisations of US ~$4.6bn and ~$3.8bn respectively. All other surviving pure-play uranium miners (producers and explorers) have market caps below US $1bn, and most of them are currently not producing uranium given rock-bottom prices.

By our estimate, at the present time there are only ~30 investible uranium companies globally, and most are small caps. In the last year, funds which focus solely on the purchase and storage of physical uranium (e.g., Uranium Participation Corp and Yellow Cake Plc) have carried out successful capital raisings and have started to gain traction with investors.

Following sector and company research, over the last six months Panah has initiated positions in four uranium mining stocks. We have selected stocks which we believe have some form of downside protection. This might be from existing higher-priced uranium contracts with the utilities which are set to continue for several years; current production of other minerals; and/or valuable assets such as mills which have high replacement costs.

Investors should be aware, however, that these stocks are junior resource companies with limited current earnings power, and which stand to gain or lose depending on the outcome of the Section 232 appeal in the near term, and fluctuations in the price of uranium in the long term. Volatility is to be expected.

Thank you for reading.

Andrew Limond, Varun Dutt

The original source material has been edited for spelling, punctuation, grammar and clarity. Photographs, illustrations, diagrams and references have been updated to ensure relevance. Copies of the original quarterly letter source material are available to investors on request.

See the Panah Fund letter to investors for Q4 2018 and the following Seraya Insight: ‘“Capital Cycle” Investing: The Market-Cycle Diaries’.

Thanks go to Michael Alkin (of Sachem Cove Partners) and Alexander Molyneux (of the Oclaner AM Uranium Opportunity Fund) for sharing their experience and knowledge.

Pitchblende is a uranium mineral now better known as ‘uraninite’, which mostly consists of UO2, with smaller amounts of U3O8, and trace amounts of radium.

See ‘Uranium Frenzy: Boom and Bust on the Colorado Plateau’ (1991) by Raye C. Ringholz.

The poster-boy for the uranium boom was Charlie Steen, who discovered a rich deposit in Utah in 1952.

The amazing story of the cartel (and ensuing US backlash) is told in ‘The Great Uranium Cartel’ (1982) by Earle Gray.

Triuranium octoxide (U3O8), a yellow powdery substance, is the most stable form of uranium oxide. Prices for uranium are usually quoted in US Dollars per lb of U3O8.

It is estimated that 400x more radioactive material was released as a result of the Chernobyl accident than by the atomic bombings of Hiroshima and Nagasaki combined. The worst affected areas were Belarus and the Ukraine.

For reference, at end-2018 Russia was reported to possess 7,850 warheads.

It is estimated that ~10% of the total electricity produced in the US from 1993-2013 was generated by uranium fuel fabricated from former Russian warheads.

As part of the fuel cycle, natural uranium (U3O8) is converted to UF6, and then enriched from ~0.7% U-235 content to ~4% U-235 for use as nuclear fuel. The enrichers have to choose what to do with the low-uranium content by-product of the enrichment process: they can store it, dispose of it, or re-enrich it further for use as fuel. This further re-enrichment is referred to as ‘underfeeding’, and the effort required to enrich U3O8 to ~4% U-235 content is measured in separative work units (‘SWUs’). In recent years, given excess enrichment capacity, it has been economically rational for the enrichers to underfeed, which has meant additional secondary supply of uranium on the market. However, as higher-priced contracts between enrichers and utilities roll off, the economics of underfeeding are becoming less attractive, which will likely mean less secondary supply of uranium from this source.

Some spent fuel can be recovered and reprocessed, though the amounts are not significant and are not anticipated to vary significantly from year to year.

Orano was formerly known as Areva.

Interestingly, an earlier Section 232 investigation on uranium in 1989 did not lead to any action being taken.

Sourced from the EIA 2017 uranium marketing annual report.

Kazatomprom recently completed an IPO for ~15% of its shares in late 2018. Our research suggests that the company’s very low costs in USD-terms are unlikely to be sustainable in the future (although this does depend to some extent on the path of the Kazakh Tenge). At present, we believe that the company is not incentivised to ramp up production, which would of course likely exert further downward pressure on uranium prices if it did happen.